For example, if the wife sold the relinquished property for $500,000 and the replacement property will cost $1,000,000.

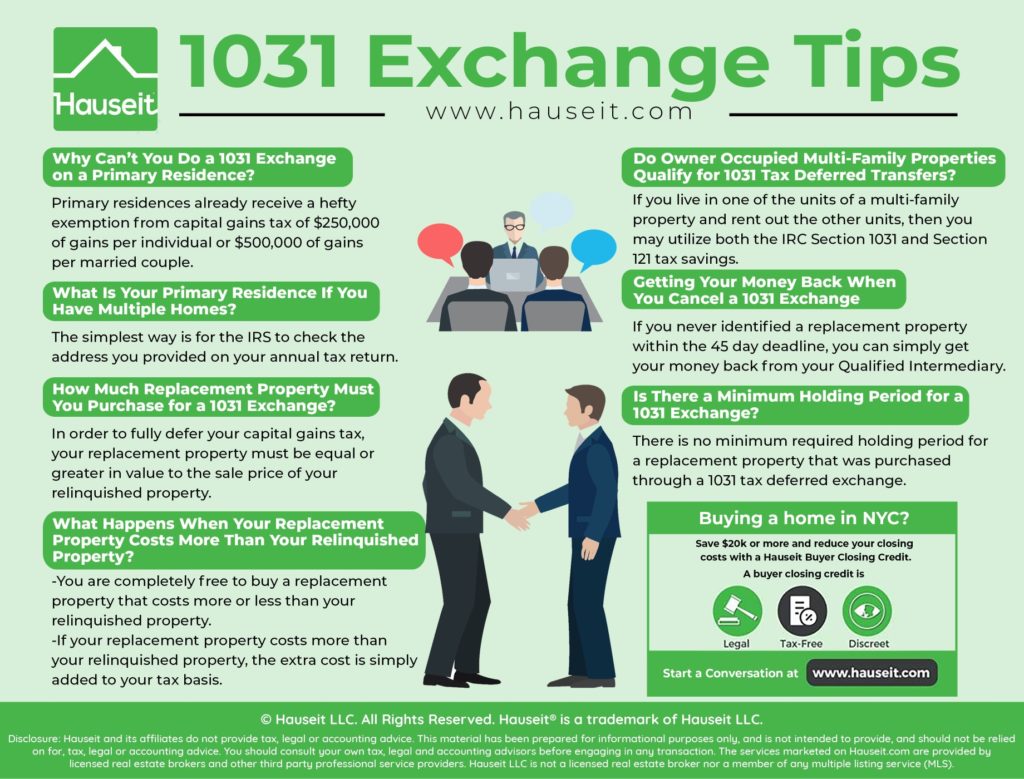

Some tax professionals will advise their clients not to make any transfers for a minimum of one to two years before or after doing a 1031 exchange in order to mitigate any “held for investment” exposure.Īlternatively, in a “trade-up” exchange, the non-exchanging spouse may acquire an interest in the replacement property if the replacement property value exceeds the value of the relinquished property. In a situation where only one spouse is on title, the other spouse can be added to the title of the relinquished property before the 1031 exchange but the timing is very important. Taxpayers are encouraged to discuss this issue with an advisor. As of 2020, the IRS has not provided guidance directly addressing how §1041 would or would not comport with the “same taxpayer” rule of §1031.

However, this TAM pre-dates the current version of IRC §1041, which provides for non-recognition of a gain or loss on a transfer of property between spouses or a transfer incident to a divorce. The IRS ruled that since the wife was not on deed to the replacement property, she was deemed to have gifted her share of the proceeds to her husband thereby failing her exchange and required to report 50% of the gain on the sale of the property. In a technical advice memorandum (TAM 8429004), a relinquished property was sold by both husband and wife as tenants in the entirety, and the replacement property was acquired solely in the husband’s name. If property is held by a husband and wife jointly on the title when they sell the relinquished property then both of the spouses can be on the title when buying replacement property. If only one of the spouses is on the title to the relinquished property then that spouse, as exchanger, should be on the title to the replacement property for an interest equivalent to the exchange value. Married couples can face some challenges to the “same taxpayer” rule in non-community property states where husband and wife are deemed separate taxpayers. One of the basic rules of a 1031 exchange requires, with limited exceptions, the taxpayer selling the relinquished property to be the same taxpayer purchasing the replacement property.

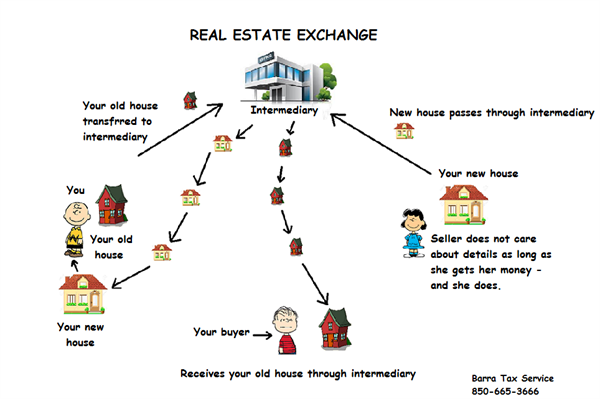

Call David J.An IRC §1031 tax deferred exchange allows owners of business or investment property to exchange into other business or investment property and defer paying capital gains tax. You may also be advised to claim an exchange even though they have taken possession of cash proceeds from the sale. Many promoters of like-kind exchanges refer to them as “tax-free” exchanges not “tax-deferred” exchanges. Sales pitches may encourage taxpayers to exchange non-qualifying vacation or second homes. You should be wary of individuals promoting improper use of like-kind exchanges. Typically, they are not tax professionals or a qualified attorney. Beware of Scams and Inexperienced individuals

Franks has completed hundreds of these transactions, making sure all documents are accurate and filed on time, potentially, saving thousands of dollars in penalties. If you do not specifically follow the rules for like-kind exchanges, you may be held liable for taxes, penalties, and interest on your transactions. David J.

#IRC 1031 HOW TO#

There can be both deferred and recognized gain in the same transaction when a taxpayer exchanges for like-kind property of lesser value.Īt Franks & Roeder we can determine if you qualify for a 1031 Like-Kind exchange and how to structure the exchange based on your specific situation to achieve the best benefit for you. If you receive cash, relief from debt, or property that is not like-kind, however, you may trigger some taxable gain in the year of the exchange. The 1031 exchange can include like-kind property exclusively, or it can include like-kind property along with cash, liabilities and property that are not like-kind. Financial gains deferred in a like-kind exchange under a 1031 Exchange is tax-deferred, but it is not tax-free. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain, if you reinvest the proceeds in similar property as part of a qualifying “like-kind” exchange. When you sell a business or investment property you may have an overall gain, you generally have to pay tax on the gain at the time of sale.

0 kommentar(er)

0 kommentar(er)